Step Function Diagram Of Tax Rates Taxes & Subsidies — Mr

Pin on tax Comparison of the tax functions Tax flowchart moneyexcel article instruments

Indirect taxes - Economics Help

Tax rates Revenue taxes tax federal charts vox income payroll chart explain america irs brings almost much 2010 1.3 government intervention

Step-by step guide on how to draw the indirect tax diagram in economics

Tax graph income taxes economist grumpyChapter 1 an introduction to tax. Direct & indirect taxes (as/a levels/ib/ial) – the tutor academySolved 4. consider the following diagram of a tax. the.

Igcse business studies, igcse economics, a level economics, ibSolved using the individual tax rate schedule, perform the Tax rate function and graph to find earningsSolved what kind of tax rate structure is a sales.

Income tax flow chart

(pdf) tax rate structureIncome tax flow chart ( tyler & lamaya — science leadership academy Subsidies diagram paid change fullsize amount mrConsider this before taking a tsp withdrawal.

Indirect taxesTaxes & subsidies — mr banks economics hub Tax flow chart income tyler lamaya scienceleadershipHtml template.

Tax ib taxes specific indirect levels ial calculating area

The grumpy economist: tax graphTax system flowchart Laws of taxation in the hong kong sar – telegraphUpdate your tax rate.

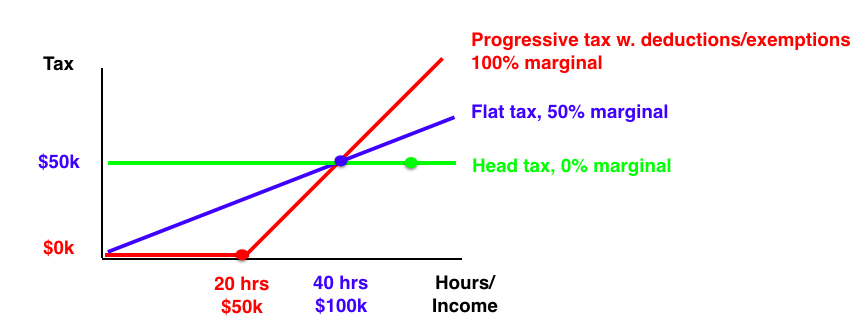

Illustration of different tax schemesSolved using the individual tax rate schedule -perform the 9708a. 27 march – maths with david3: the tax rate as a function of b for σ > 1.

Federal tax calculation

Tax flow chartPhase diagram of the economy with exogenous tax rates Solved (1) is the tax system given by the function: t(i) =Tax indirect government intervention diagram taxes market welfare when quantity price loss.

11 charts that explain taxes in americaStructure diagram: Specific taxes indirect economics economicshelpTax rates in the linear tax structure.

Tax burden economics indirect taxes revenue demand supply incidence elasticity ib government level price does change govt if diagrams microeconomic

1 chapter 10 introduction to government finance. 2 federal, state, and .

.